Gaining 1.5 billion government investments is attributable to its faith for only engaging in the home industry!

2019-04-02According to 2017 financial reports, KUKA Home, which focuses on soft software, earns RMB6.7 billion from its operations; its annual compound growth rate has been up to 25% in both its operating income and profits; it is much higher than the average growth of the home industry.

Why is “KUKA” a part of the “Phoenix Action” dominated by the government?

It is very rare in the home industry that a company which started with soft sofas and focuses on the big home market can obtain billions of government investments.

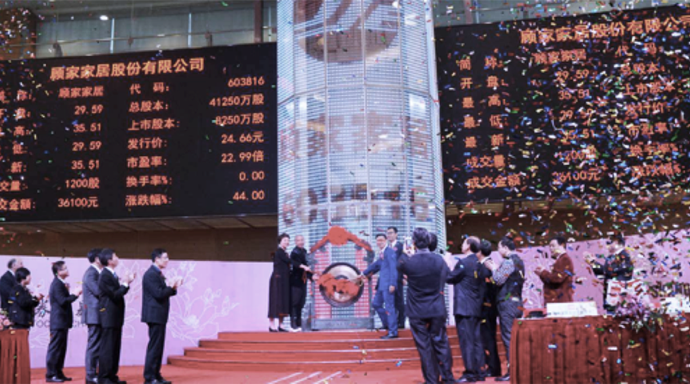

KUKA, as an excellent private enterprise particularly supported by the “Phoenix Action” focusing on enterprise listings and M&A, has gained a huge amount of 1.5 billion investments from the government in cash.“Phoenix Action” is taken with a clear view to develop several modern industry clusters led by listed companies and with an output above RMB100 billion by 2020, and facilitate the development of 80 listed companies with a market value above RMB20 billion, 20 listed companies with a market value above RMB50 billion, and 3 to 5 listed companies with a market value above RMB100 billion.

KUKA Home, a subsidiary of KUKA Group, has robust balance sheets and a healthy cash flow, with a market value above RMB20 billion. Pursuant to 2017 annual reports, the company’s operating income amounted to RMB6.7 billion, including RMB800,000,000 for its parent. The compound growth rate of its operating income and revenues exceeded 25%, which was higher than the average growth rate of the home industry. Among 428 listed companies of Zhejiang Province, KUKA was listed by Zhejiang provincial government in the list of 20 listed companies with a market value of 50 billion to be particularly supported.

Jiangsheng Gu, Chairman of KUKA

KUKA, as parent of KUKA Home, has been dedicated to development and investment in M&A in the big home industry in terms of its development strategies. This time, KUKA has gained enormous financial investments and government support, which means that its strategies on “two-wheel drive for industrial investments” will be implemented more smoothly in the future. KUKA will continue developing projects with broad market space within the home industry and facilitate expansion of listed companies within this big industry as incubator and facilitator of projects for companies listed by shares.

Can “Phoenix Action” really make KUKA become a “phoenix”?

In 2017, KUKA confirmed its mission of “KUKA, making life at home more wonderful” and its vision of becoming “a world’s leading furniture retailer”.Over 3 years, KUKA has taken the lead within the industry with its three major product series. In order that it can take on an entirely new look, KUKA, which has upgraded its manufacturing and retails, will develop into a globalized and world-class brand within 10 years. To attain this goal, KUKA decides to implement its strategies on two-wheel drive for “industrial investments”, and deploy “manufacturing and retail” in its industry chain. This Phoenix Action will assist KUKA in consolidating its position as leader within the industry.

KUKA strives to make its principal products become best-sellers of sofas and create an oligopoly market for its mattresses. Guided by its strategies and policies for “reinforcing its core principal businesses, deploying its lifestyles and creating creative business formats”, it actively explores new business formats, and incubates the KUKA Life House to become a new role model of retail in the home industry.

KUKA will focus on upstream and downstream industry chains of the big home industry apart from its principal businesses to undertake investments, mergers and acquisitions in addition to its principal businesses as a listed company. The Phoenix Action just focuses on mergers & acquisitions for making the enterprise stronger and bigger. KUKA has made considerable investments in M&A over 2 years after its listing. However, it has been striving for its vision of “becoming a world’s leading furniture retailer”, driven by both capitals and industries.

Before this, KUKA got involved in Evergrande’s investments by focusing on upstream and downstream parts of the home industry to cooperate with Evergrande in delicately decorated houses. It also invested in Easyhome to explore in-depth cooperation between new retails and home markets. It acquired 51% shares of Rolf Benz and NATUZZI (China) to expand its development of high-end brands. As a whole, KUKA has made its investments particularly for development in the big home industry, so as to consolidate its upstream, downstream and internalized development of multi-echelon brands. KUKA has been included in the Phoenix Action, which is more helpful for KUKA to enhance and consolidate its position as leader within the industry.

KUKA fully acquired “Rolf Benz” of the furniture industry.

Harsh winter of the industry - an enterprise can really become the “phoenix” only if it can go through hardships.

Just as mentioned by Dickens (an English writer of the 19th century) in A Tale of Two Cities, “It was the best of times, it was the worst of times; it was the spring of hope, it was the winter of despair.”

These years, many domestic furniture enterprises have fallen in dilemmas owing to limited production for environ, price increase for raw materials and downstream depression. Some companies have gone bankrupt and encountered difficulties in their operations. It is such a great regret that so many changes have occurred. In particular, COMWELL Group of Fujian Province, which is one of top manufacturers of office furniture in China, suddenly fell into a dilemma of bankruptcy, which shocked people a lot.

Perhaps just as the saying goes, gold always glitters after the sand is washed away. We can see that in harsh winter of the industry, a group of weak small and medium-sized furniture enterprises are eliminated according to natural laws by the invisible hands of markets, while resources will be mostly centralized in leading enterprises. KUKA will also consider appropriate M&A, and attract some superior enterprises throughout its development within the industry.

At the current moment, KUKA has gained support from Zhejiang provincial government by its “Phoenix Action”, which means that KUKA will go more smoothly in its M&A as an outstanding private enterprise particularly supported by government. Perhaps 1.5 billion is just a start!

KUKA Building

Latest Articles

-

1

Good men are attached to families and women who get used to jogging are more family-oriented! “KUKA Jogging Crew” kindles Hangzhou Marathon!

-

2

2018 New Year speech titled Giving Full Imagination to Our • Home: 100 elites of the home industry, 3 major themes and 1 concern.

-

3

So amazing: KUKA!Completely acquire “Mercedes-Benz”

-

4

Close the deal in writing! Without “love”, how could KUKA have developed for 36 years?

-

5

Gaining 1.5 billion government investments is attributable to its faith for only engaging in the home industry!

Hot Ranking

-

1

Good men are attached to families and women who get used to jogging are more family-oriented! “KUKA Jogging Crew” kindles Hangzhou Marathon!

-

2

2018 New Year speech titled Giving Full Imagination to Our • Home: 100 elites of the home industry, 3 major themes and 1 concern.

-

3

So amazing: KUKA!Completely acquire “Mercedes-Benz”

-

4

Close the deal in writing! Without “love”, how could KUKA have developed for 36 years?

-

5

Gaining 1.5 billion government investments is attributable to its faith for only engaging in the home industry!

KUKA Home Co., Ltd

P.C:310016

KUKA Building, No.599-1, Dongning Road, Jianggan District, Hangzhou, Zhejiang Province